Award-winning PDF software

Missouri Medicaid Application: What You Should Know

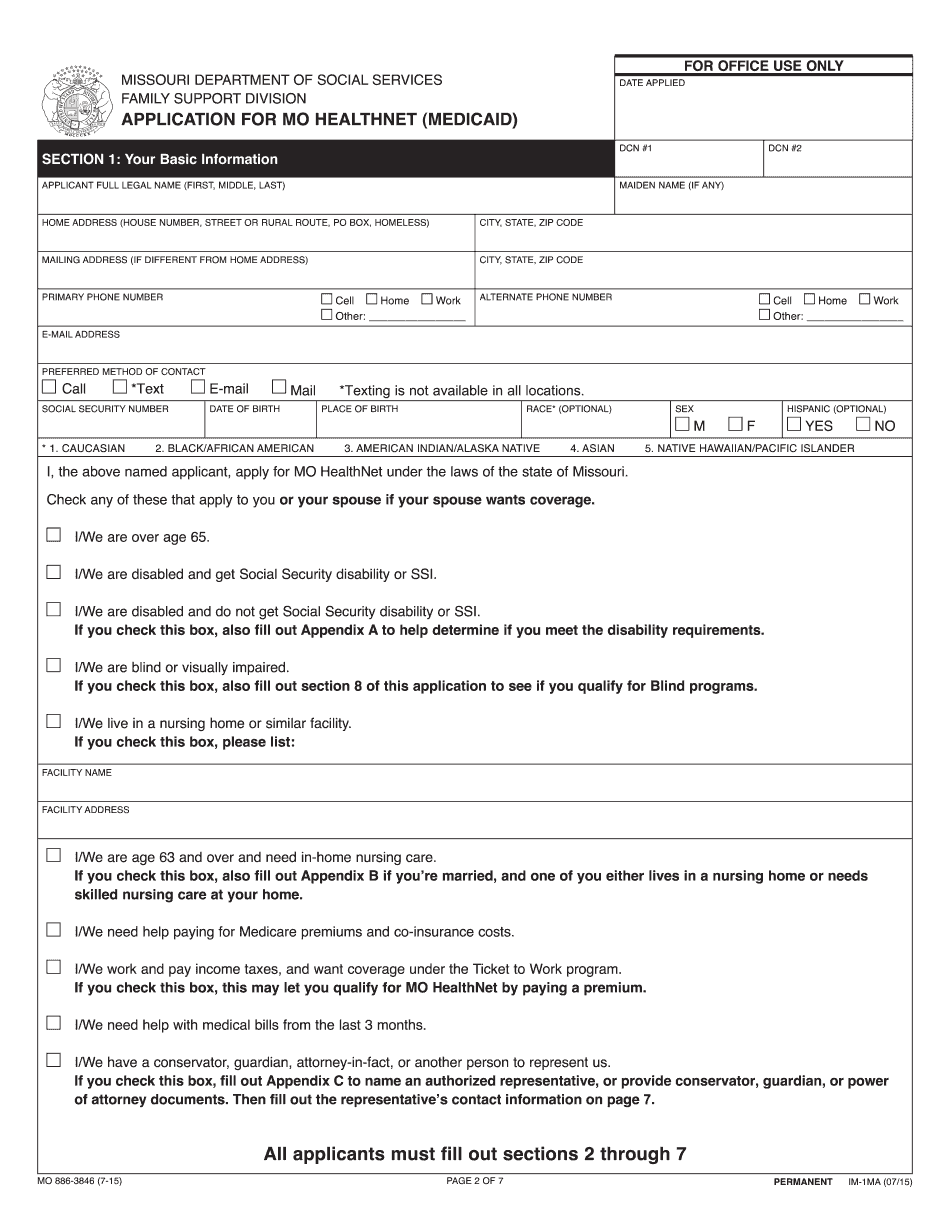

MO Healthier Healthier is a federal waiver that offers subsidies to the uninsured while making health insurance accessible to people with low incomes, ages, and disabilities. Read More About MO Healthier and Medicaid If you are an employer with 50 or more employees, and you have less than 50 employees, you can receive up to 32 percent of your wages as tax-free payroll tax credits to help pay your share of your eligible employees' health insurance premiums. Learn more about the health insurance tax credit at MRS.gov. You can find more information on the health insurance tax credit at myDHS.com. Disability — my DSS I have been told that in the past it has been difficult to find a provider for an individual with an autism spectrum disorder or other disability at a mental health professional referral service. Now, I have found a new provider which I am happy about. They have also been able, without me having to do anything special, to find my new insurance provider (also located out of state). My DSS (DHS) has been providing services to me since December 2013. When I started out I was on Medicare, Medicaid, Median, and a few other medical plans. My income fluctuates. I need a home care or day program. I have a disability but have no disabilities. If you are disabled it is necessary to make up the difference between what you are receiving from any state or federally funded programs and what it costs to continue to receive those services. That is why Medicaid is necessary. I have no problem paying for my home care services; my income is low enough that I can pay all of it when I get home from work. Some day, I will get my home care and go back to work. When you have some money, it helps you pay for it. My new provider also helps me with expenses like my insulin pump and insulin pens. My husband works for a non-profit; I have a job for the first time. That has provided me with some unexpected financial assistance. I do not receive Social Security benefits because I do not receive Medicare insurance. I do not qualify for either the earned income tax credit for a lower income, or Child tax credit for a lower income. Furthermore, I have an ERA for my daughter because I am the primary caretaker for her, she stays at my house most nights, and most weekends.

Online answers make it easier to to prepare your document administration and strengthen the efficiency of one's workflow. Adhere to the fast handbook with the intention to full Missouri Medicaid Application, keep away from mistakes and furnish it in the timely manner:

How to accomplish a Missouri Medicaid Application on the internet:

- On the web site with all the type, simply click Start Now and go to your editor.

- Use the clues to fill out the applicable fields.

- Include your individual facts and make contact with knowledge.

- Make certain that you simply enter correct details and figures in ideal fields.

- Carefully take a look at the information belonging to the form in the process as grammar and spelling.

- Refer to help you segment should you have any issues or deal with our Guidance team.

- Put an digital signature with your Missouri Medicaid Application with the help of Signal Instrument.

- Once the shape is concluded, press Finished.

- Distribute the all set form by way of email or fax, print it out or conserve in your product.

PDF editor helps you to make adjustments to the Missouri Medicaid Application from any net linked unit, customise it in accordance with your requirements, signal it electronically and distribute in numerous ways.